Preparing a client’s return for a bank product

|

1

|

|

3

|

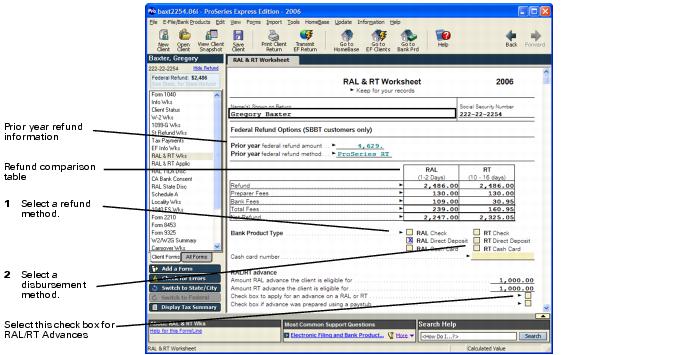

If you are a Santa Barbara Bank and Trust (SBBT) customer, complete the following sections on the RAL & RT Worksheet, then continue with steps 4 and 5.

|

|

If you are a First Security and Republic Bank customer, scroll down to the bottom of the RAL & RT Worksheet to select a financial institution and bank product type.

You’ll process the client’s bank product through the proprietary software that you received from First Security Bank or Republic Bank after the return has been accepted by the IRS. Skip to step 6.

|

Steps 4 and 5 that follow are for Santa Barbara Bank and Trust (SBBT) customers only:

|

4

|

If you select “RAL” or “RT” on a client’s RAL & RT Worksheet, the program enters the type of refund in the Refund Method column in the EF Clients view. Before you transmit a return, verify that the appropriate bank product is identified in the Refund Method column.

|

|

5

|

When the electronically-filed return is accepted or the bank product authorization is received, the program enters the type of refund in the Refund Method column in the Bank Products Clients view. You might receive the bank product authorization before you receive a status message that the electronically-filed return was accepted.

|

For all Bank Products customers, continue with these steps:

|

6

|

Complete the client’s federal return. Make sure you complete the Electronic Filing Smart Worksheet on your client’s Form W-2, 1099-R and W2-G Worksheets.

|

|

7

|

To check the return for possible errors and omissions, click the Check for Return Errors button on the left navigation bar.

|

|

8

|

Correct any detected errors, then click the Check for Return Errors button again.

|

|

10

|

Print your client’s federal Form 8453, U.S. Individual Income Tax Declaration for an IRS e‑file Return, then review the form and the return with the client.

|

|

11

|

Print your client’s federal Refund Application Loan and Refund Transfer Application form, review the form with the client (including all fees), then have the client sign it.

|

|

12

|

|

13

|

Print your client’s Refund Anticipation Loan Truth-in-lending disclosure form, review the form with the client, then have the client sign it. Retain this form for your records.

|

Other forms that can print when there is a RAL attached to a client’s tax return:

|

14

|

Go to the EF Clients View by clicking the EF Clients tab, scroll across to the Refund Method column, then verify that the appropriate bank product is identified.

|

For more detailed information, refer to Converting a tax return into electronic filing format and Transmitting a tax return to the Intuit Electronic Filing Center.

Bank product naming conventions

Here are the names or acronyms that each bank uses for these bank products:

|

Refund Anticipation Loan

|

Refund Transfer Check

|

Refund Transfer Direct Deposit

|

|

|

Santa Barbara Bank & Trust

|

|||

|

Electronic Refund Check (ERC)

|

Electronic Refund Deposit (ERD)

|

Disbursement methods

When you have a tax return with a Refund Anticipation Loan (RAL) or Refund Transfer (RT), you can select one of three disbursement methods:

|

▪

|

Check. Your client receives a refund via a check that you print.

|

|

▪

|

Direct Deposit. Your client’s refund is deposited directly into his or her bank account. This disbursement method is only available for RTs. If you choose this method, you must enter the bank information in the Bank Account Information section of the RAL & RT Worksheet.

|

|

▪

|

Cash Card. Your client receives a card that can be used to withdraw the loan balance at any ATM machine. If you choose this method, you must also enter a valid cash number. Refer to the Cash Card Disclosure for Bank Products for a schedule of fees.

|

Applying for RAL and RT Advances

Your client can apply for an advance of up to $1,900 against his or her RAL or RT. The maximum potential RAL advance and RT advance that your client is eligible for is displayed on the RAL & RT Worksheet. These amounts can be different. Check the box to apply for an advance when you transmit your client’s return. The RAL/RT advance application is processed immediately.

Applying for Pre-season RAL/RT Advances

Pre-season RAL/RT Advances allow you to accomodate clients who want their tax refund early in the tax year. You can offer this bank product to your clients who already have their employer’s W-2 in hand. In addition, you can also offer Pre-season RAL/RT Advances to your clients who have their end-of-year pay stubs from their employer.

You’ll be able to transmit RAL/RT Advances using Santa Barbara Bank & Trust as the bank product provider as early as December 29, 2006.

If you are going to offer Pre-season RAL/RT Advances, you must advise your clients that their tax returns will not be sent to the IRS until the Intuit Electronic Filing Center opens for e-filing in mid-January 2007.

To prepare and transmit a Pre-season RAL/RT Advance:

|

2

|

Open the RAL & RT Worksheet in the client's tax return and select the refund method of either RAL or RT.

|

|

3

|

Make sure that you select Check box to apply for an advance on a RAL or RT on the client's RAL & RT Worksheet.

|

|

5

|

Select the Go to EF Clients button on the toolbar.

|

|

6

|

Select the client's return in the EF Clients view. You can only select one return at a time in the EF Clients view when transmitting RAL/RT Advances.

|

|

7

|

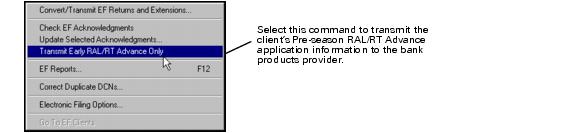

From the E-File/Bank Products menu, select Electronic Filing, then select Transmit Early RAL/RT Advance Only.

|

|

The ProSeries Express Edition program sends only the client’s bank products application information to the bank, your client’s tax return data is not transmitted.

|

|

8

|

When the bank approves the pre-season RAL/RT Advance, you can either print your client's refund check or provide your client with a refund cash card. You can receive bank approval for your client’s RAL/RT Advance within a few minutes.

|

|

9

|

When the Intuit Electronic Filing Center opens for e-filing in mid-January 2007, you can electronically file your client’s tax return. For more information about how to transmit a tax return, see Converting and transmitting a tax return. For more information about how to check for return acknowledgements, see Checking for electronic filing return acknowledgments.

|

|

To quickly determine the status of a client’s return with an Pre-season RAL/RT Advance, select the EF Clients tab then scroll to the right to the Early RAL/RT Transmit Date column. You can sort this column by the date that the Early RAL/RT was transmitted.

|