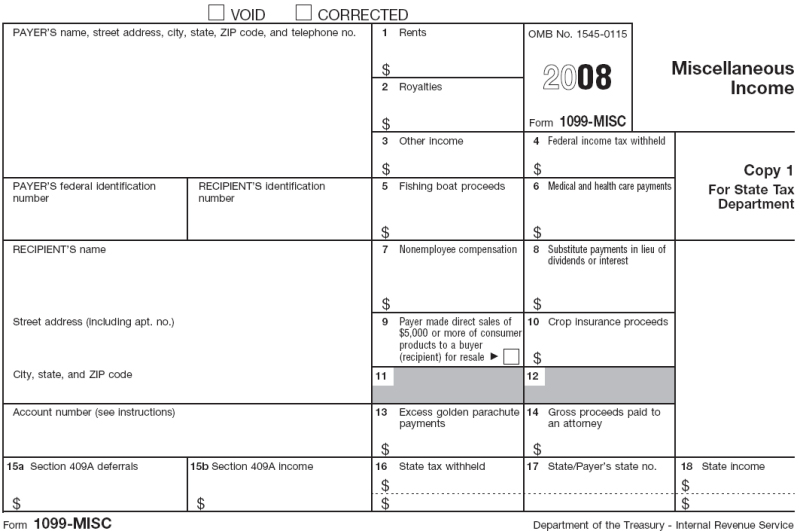

Clickable Form 1099 for 2008

Businesses must provide a Form 1099-MISC, which is a report of the amount paid ot an independent contractor, by January 31 to each contractor they used during the previous year. Businesses must also send Copies A of all paper Forms 1099-MISC and a Form 1096, a summary of 1099 forms, to the Internal Revenue Service (IRS) by February 28 (or March 31 if you file electronically).

Click any blank on the form to see the IRS instruction, how QuickBooks derives the information, and troubleshooting tips.

Assisted Customers: For additional information on completing 1099 forms, click

hereThis is an IRS form. In order to print your forms directly from QuickBooks, you must purchase pre-printed forms. Click here to go to our tax forms page where you may purchase forms. If you use QuickBooks preprinted forms, they may look different, but they have been approved by the IRS.