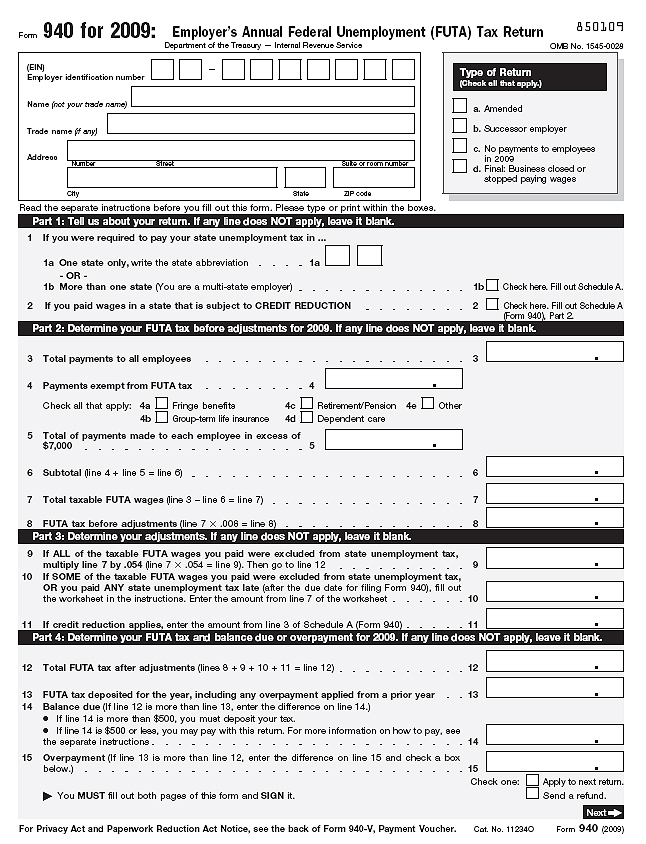

Employers must use Form 940 to report annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax. Do not deduct or collect FUTA tax from your employees' wages.

Although Form 940 covers a calendar year, you may have to deposit your FUTA tax before you file your return. If your FUTA tax is more than $500 for the calendar year, you must deposit at least one quarterly payment.