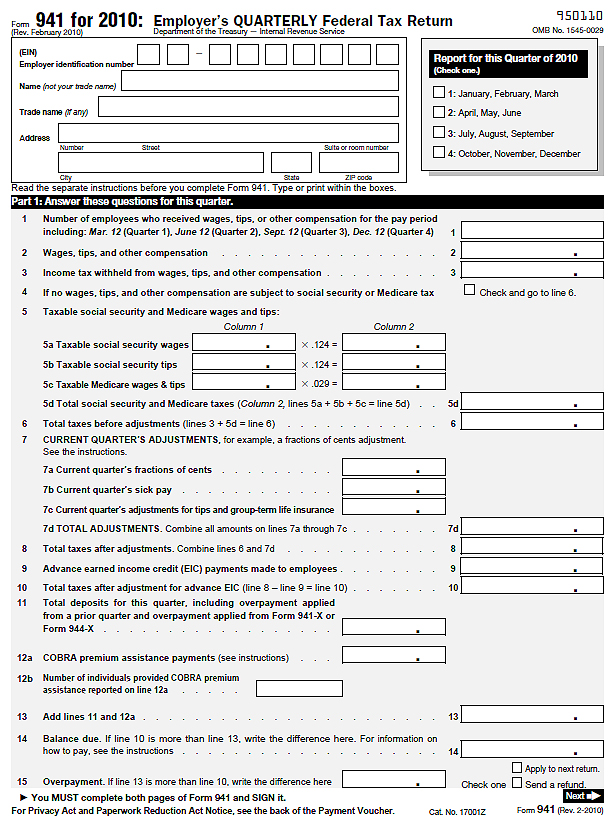

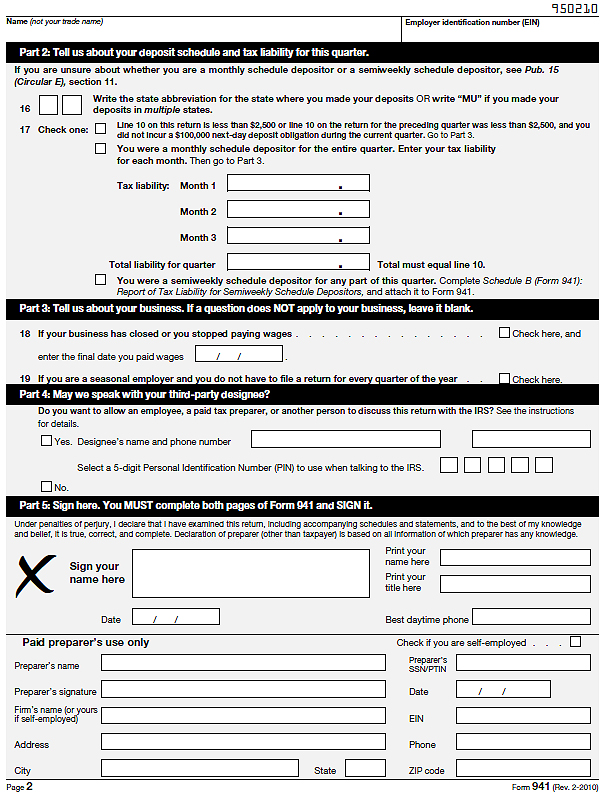

Clickable Form 941 for 2010

Employers must file a quarterly Form 941 to report wages paid, tips your employees have received, federal income tax withheld, both the employer’s and employee’s share of social security and Medicare taxes, and advanced earned income tax credit (EIC) payments. Form 941 is due by the last day of the month that follows the end of the quarter.

If any due date for filing shown above falls on a Saturday, Sunday or legal holiday, you may file your return on the next business day.