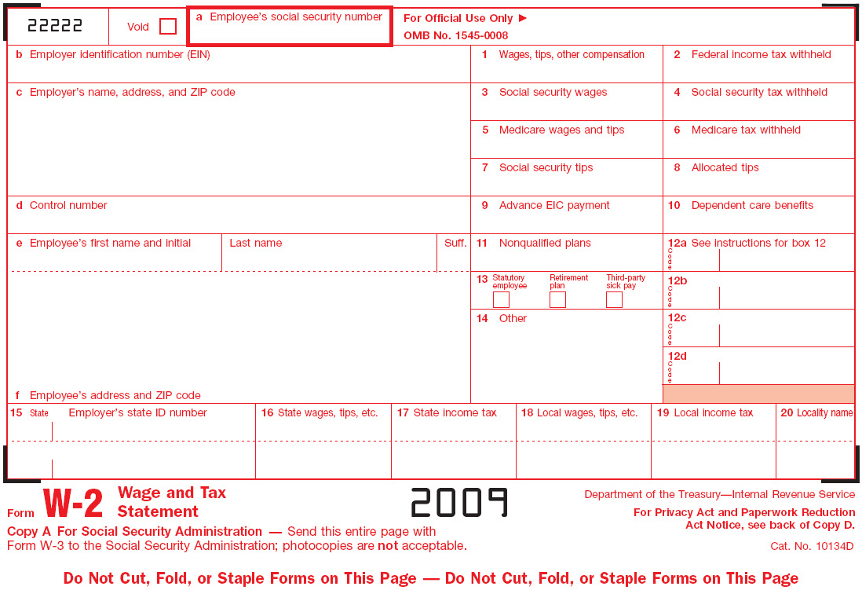

The IRS requires most employers to file payroll Forms W-2 and W-3 at the beginning of each year for the previous year. Form W-2 (Wage and Tax Statement) is the multi-part end-of-year form you send to each employee and submit to federal, state, and local tax agencies. The form shows an employee's wages and taxes withheld for the year. Form W-3 (Transmittal of Wage and Tax Statements) is a summary of all the W-2 forms you are submitting to the federal government.

Employers must give their employees Copies B, C, and 2 of their Form W-2 by February 1, 2010. Additionally, employers must file Copy A of each W-2 with the Social Security Administration, along with a Form W-3, by March 1, 2010 (March 31 if you file electronically).

To ensure that your W-2s print correctly, please review the following:

- Be sure to purchase W-2 paper that works with the payroll service you are currently using. If you are unsure which type of paper to use, go to here. If you click on the "Tax Products" tab, then select "Laser W-2 Blank Perforated Paper and Envelope Kit”, the system will send the correct W-2s based on your payroll service. Don't choose the option "W-2 Kits," on that page, as it will not give you the option of choosing your payroll service (and you may receive the wrong paper).

- Update your tax tables around mid-December, prior to printing your W-2s to ensure that the correct dates appear on the forms.