Filing returns electronically

ProSeries Basic Edition electronic filing software is installed with ProSeries Basic Edition tax products that support electronic filing.

ProSeries Basic Edition software supports electronic filing of the following:

IRS Web site. To visit the e-file Providers area of the IRS Web site, go to http://www.irs.gov, select Tax Professionals, then select e-file Providers. If you prefer, you can go directly to http://www.irs.gov/taxpros/providers/index.html.

State tax agency Web sites. To visit the Web site for a state's tax agency, go to http://www.proseries.com, select Tools, navigate to the Tax Links area, select State Tax Departments, then click the name of the state.

|

Important:

|

You must have a valid EFIN. If you don't have an IRS-issued Electronic Filing Identification Number (EFIN) yet, see Preparing for electronic filing.

|

For detailed information about electronic filing:

- Go to http://www.proseries.com, select Products, then select Electronic Filing, or

- Use the Search Help feature on the Help toolbar or in the Help Center.

Establishing an Internet connection

To file electronically, you need to connect to the Internet from the computer on which the ProSeries Basic Edition program is installed.

If you don't have an Internet connection, you must first sign up for service with an Internet Service Provider (ISP). Once you have an ISP, go to the Help menu, select Internet Connection Setup, then follow the instructions in the dialog boxes.

Setting up the ProSeries Basic Edition program for electronic filing

If you've already entered your electronic filing information, proceed to Step 1 - Mark the return for electronic filing.

If you haven't entered your electronic filing information yet, take the following steps to set up the ProSeries Basic Edition electronic filing options.

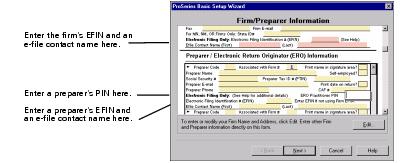

- Go to the Help menu and select Options Setup Wizard.

- In the Firm/Preparer Information dialog box, enter the firm's Electronic Filing Identification Number (EFIN) and the name of an e-file contact in the Firm Information section.

- In the Filing Client Returns Electronically dialog box, select Yes, some returns may be filed electronically.

- Complete the remainder of the Options Setup Wizard.

If a preparer has an EFIN, enter that EFIN and the name of an e-file contact in the Preparer/Electronic Return Originator (ERO) Information section.

If your firm is going to participate in the IRS' Practitioner PIN program, enter each preparer's PIN in the Preparer/Electronic Return Originator (ERO) Information section. This is a five-digit code chosen by each preparer.

PINs. PINs (Personal Identification Numbers) are used as electronic signatures. When you use a PIN, you don't mail Form 8453 to the IRS.

If more than one computer will be using the same EFIN

When ProSeries Basic Edition software is installed on a computer, the DCN (Declaration Control Number) counter is set at "00001." The program assigns that number to the first federal return that's marked for electronic filing, then increments the DCN counter by "1." As each subsequent federal return is marked for electronic filing, the program assigns the current DCN to that return, then increments the DCN counter by "1."

|

Tip:

|

If a computer will be using a unique EFIN, it's not necessary to change the starting number in the DCN counter for that computer.

|

To change the starting number in the DCN counter for a computer:

Step 1 - Mark the return for electronic filing

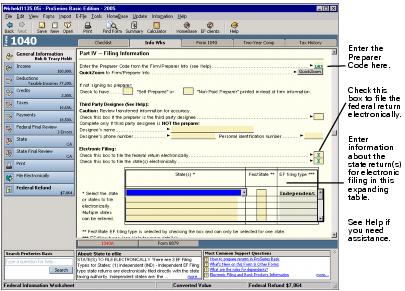

- Open the client's federal return, go to the Federal Information Worksheet, scroll down to Part IV - Filing Information, then make sure the appropriate preparer code is entered in the Preparer Code field.

- Make sure the Check this box to file the federal return electronically box is checked.

- State returns. If you're going to file the client's state return(s) electronically, enter the appropriate information in the Choose state(s) to file electronically expanding table.

|

Tip:

|

If you're acting as an ERO and filing a return for another preparer, enter that preparer's preparer code in the Preparer Code field.

|

Note the following about the three EF filing types for state individual returns.

- Enter all other relevant information in the Filing Information section.

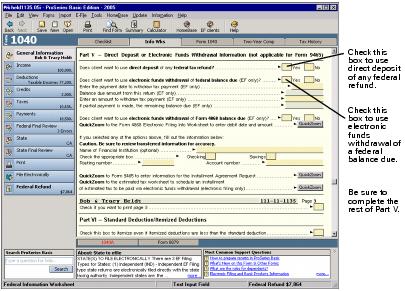

- Direct Deposit/Direct Debit. If the client wants their refund deposited directly into their account or the balance due withdrawn from their account, complete Part V - Direct Deposit or Electronic Funds Withdrawal Information.

PIN Information. If you're participating in the IRS Practitioner PIN Program and the client wants to use PINs, complete the appropriate fields in the Practitioner PIN Program section.

Step 2 - Prepare the client's return(s) for electronic filing

- Complete the client's federal return.

- Complete the Electronic Filing Smart Worksheets on the client's Form W-2, 1099-R, W2-G, and 1099-G worksheets (if applicable).

- RAL or RT. If you're offering Bank Products through Santa Barbara Bank & Trust and the client wants a Refund Anticipation Loan or Refund Transfer, complete the applicable parts of the Bank Product Information Worksheet.

- Click the State button in the Left Navigation Area.

- Complete the client's state return.

- Click the General Information button in the Left Navigation Area.

- Go to the toolbar and click the Save button.

|

Tip:

|

See Avoiding common reasons for rejection after step 7.

|

For more information, see Overview of Bank Products.

Avoiding common reasons for rejection

- Verify the client's social security number (SSN) and Date of Birth (DOB) with the Social Security Administration (SSA).

- If you're preparing a Married Filing Joint return, verify that the spouse's last name on the return matches the spouse's last name on his or her Social Security card.

- Make sure the employer's name and federal identification number on the actual Form W-2 match the information you've entered in the ProSeries Basic Edition program.

- Make sure the payer's name and federal identification number on the actual Form W-2G or Form 1099-R match the information you've entered in the ProSeries Basic Edition program.

- Use error-checking during data entry. To do so, open a return, then go to the View menu and make sure there's a check mark before Error Alerts.

Step 3 - Run Final Review from the client's return

After you complete a federal or state return, run the ProSeries Basic Edition Final Review to help you check the return for errors.

- To review the open federal return, click the Federal Final Review button in the Left Navigation Area.

- Analyze the Final Review report, and fix all errors that are identified.

- Click Recheck to check the return for errors.

- Not using PINs. If you're not participating in the IRS Practitioner PIN program, review Form 8453 in the client's federal return. (If you're participating in the IRS Practitioner PIN program, you don't need to file Form 8453 with the IRS.) Also review the electronic filing paperwork form in the client's state return, if applicable. Review the form(s) and return(s) with the client.

- Using PINs. If you're participating in the IRS Practitioner PIN program and the client wants to use a PIN, go to the IRS e-file Authentication Statement in the client's federal return, make sure the box at the top of the form is checked, then complete the remainder of the form.

To review the open state return, click the State Final Review button in the Left Navigation Area.

Tip: The ERO PIN is used as an electronic signature. An ERO PIN can be any five digits (except all zeros). You enter your PIN in the Firm/Preparer Info section of the Options dialog box.

For more information, click the Help button ![]() while the IRS e-file Authentication Statement is open on the screen. Review the form and the return(s) with the client.

while the IRS e-file Authentication Statement is open on the screen. Review the form and the return(s) with the client.

Step 4 - From the EF Clients view, select the return(s)

You can select a client's return(s) for electronic filing from the client's open return or from the HomeBase EF Clients view.

Selecting returns from the client's open return

- Click the File Electronically button in the Left Navigation Area.

- In the Electronic Filing dialog box, check the box for each of the client's returns that you want to file electronically.

- Click OK.

%20dialog%20box.jpg)

The program closes the client's return, opens HomeBase with the EF Clients tab selected, then starts the electronic filing process.

Selecting returns from the HomeBase EF Client's view

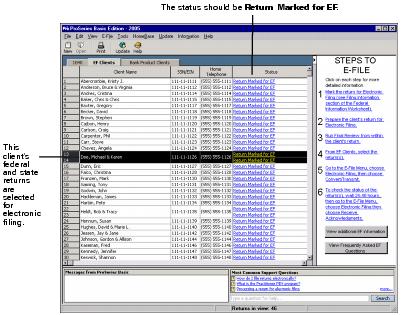

- If HomeBase is on the screen, click the EF Clients tab below the toolbar. If a client's return is on the screen, go to the toolbar and click the EF Clients button.

- Select the client's returns that you want to file electronically. Their status should be Return Marked for EF.

The HomeBase EF Clients view presents important information about each client return that you've prepared and marked for electronic filing, including the status of each return.

State returns. State returns are listed after the client's federal return. Select a client's federal and state returns at the same time. To select more than one return, hold down the CTRL key while you click each return that you want to file electronically.

|

Tip:

|

If you select returns for more than one client, the program instructs you to select the return(s) for only one client.

|

Step 5 - Convert and transmit the selected return(s)

You can convert and transmit a client's return(s) from the client's open return or from the HomeBase EF Clients view.

Transmitting returns that were selected from the client's open return

If you selected a client's return(s) for electronic filing from the client's open return (as explained in Selecting returns from the client's open return), take the following steps:

- If the Electronic Filing Transmission dialog box asks "Do you want to continue with the convert/transmit process?", select Yes.

- Dialog boxes keep you informed. When the program finishes transmitting the return(s), the Electronic Filing Transmission log opens. This log indicates whether each return was successfully transmitted and, if returns were not successfully transmitted, the reason why they were not successful.

- Click Print to print the contents of the Electronic Filing Transmission log.

- Click Close to close the Electronic Filing Transmission log.

Transmitting returns that were selected from the HomeBase EF Clients view

If you selected a client's return(s) for electronic filing from the HomeBase EF Clients view (as explained in Selecting returns from the HomeBase EF Client's view), take the following steps:

- Go to the E-File menu, select Electronic Filing, then select Convert/Transmit Returns and Extensions.

- If any informational dialog boxes appear, read the information, then click OK.

- If you see a Pay-Per-Return dialog box, authorize payment for the indicated client files.

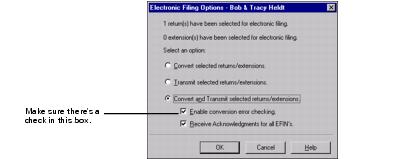

- In the Electronic Filing Options dialog box, select Convert and Transmit selected returns/extensions.

- Make sure the Enable conversion error checking box is selected.

- Check the Receive Acknowledgments for all EFINs box if more than one EFIN was entered in the Firm/Preparer Information section of the Options dialog box and you want to receive electronic filing acknowledgments for all EFINs (not just the EFIN associated with the return that's being electronically filed now).

- Click OK.

When the ProSeries Basic Edition program finishes converting and transmitting the returns, the Transmit Electronic Filing Returns/Extensions Log opens so you can review the results.

Step 6 - Wait 24 to 48 hours, then check for acknowledgments

To check for acknowledgments from the IRS or state taxing authorities:

- Go to the HomeBase EF Center. If HomeBase is on the screen, click the EF Clients tab below the toolbar. If a return is on the screen, go to the toolbar and click the EF Center button.

- Click the client's status in the Status column of the EF Center to open the client's Electronic Filing Client Status History.

- Review the Electronic Filing Client Status History and identify the most recent status of the client's return, then click Close.

- If the most recent status of the return is "Return Accepted," proceed to Step 7 - Complete the electronic filing process.

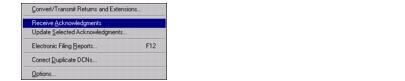

- Go to the E-File menu and point to Electronic Filing.

- From the Electronic Filing menu, select Receive Acknowledgments to get the latest acknowledgments.

- In the Receive Electronic Filing Acknowledgments Log, click View Acks to see the detailed Acknowledgment Report.

- Review the information, then click Close. If the return was rejected, continue with Resolving a problem with a rejected return next.

|

Tip:

|

Entries in the Status column are blue and underlined. A client's status becomes bold when your mouse pointer rests on it.

|

|

Tip:

|

If a client's return was rejected, the report shows why it was rejected, and how to fix the error.

|

If the most recent status of the return is "Return Rejected," proceed to Resolving a problem with a rejected return.

If the most recent status of the return isn't "Return Accepted" or "Return Rejected," continue with step 5.

If there aren't any acknowledgments, View Acks is not available. In most cases, you will receive a client's federal acknowledgment before you receive the client's state acknowledgment.

Resolving a problem with a rejected return

- Go to the HomeBase EF Center.

- Go to the E-File menu, point to Electronic Filing, select Reports, then print a Rejected Returns report.

- Incorrect SSN. If a return was rejected because the taxpayer's social security number wasn't correct, print the Intuit Electronic Postmark Report before correcting the social security number and resubmitting the return. This provides the original date and time of filing.

- Fix the errors in the rejected return.

- Make sure the corrected return passes Final Review.

- Convert and retransmit the corrected returns as explained in Step 4 - From the EF Clients view, select the return(s) and Step 5 - Convert and transmit the selected return(s).

Re-filing state returns. If you've filed a client's federal and state returns together and the federal return is accepted but the state return is rejected, in most cases you can re-file the corrected state return electronically. However, you cannot re-file corrected Hawaii returns, Oklahoma returns, or Oregon returns electronically because they can only be filed with the client's federal return. To re-file a corrected Hawaii return, Oklahoma return, or Oregon return, you must print the return, then mail it to the appropriate state taxing authority.

Step 7 - Complete the electronic filing process

After the IRS or state taxing authority has accepted a return, take these steps to complete the filing process:

- Federal returns - Not using PINs. If you and your client are not using PINs, attach any required paper documents to Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return. Do this for each federal return that has been accepted, then continue with step 2.

- After you've been informed the federal return was accepted, mail the completed Form 8453 to the appropriate IRS service center within three business days.

- State returns. After you've been informed the state return was accepted, mail the completed state electronic filing paperwork to the appropriate state service center within the time period required by the appropriate taxing authority (if the state taxing authority requires electronic filing paperwork).

- Print Form 9325, Acknowledgment and General Information for Taxpayers Who File Returns Electronically, and give it to your client.

- Balance due. If you filed a balance-due return and your client did not elect to pay with a credit card or to have their bank account directly debited, print Form 1040-V, Balance Due Payment Voucher and give it to your client.

- Getting current information. To review common reject reasons, troubleshooting information, and frequently-asked questions from http://www.proseries.com, do either of the following:

- While in the ProSeries Basic Edition HomeBase EF Clients view, go to the Steps to E-File section, then click the View Frequently Asked EF Questions button.

- While in your Internet browser, go to http://www.proseries.com, select Products, then select Electronic Filing.

|

Tip:

|

The Preparing Form 8453 section of the Electronic Filing Information Worksheet identifies the paper documents to attach to the client's Form 8453. Also note that you might need to complete a state form that's comparable to the federal Form 8453 for each electronically-filed state return that's accepted, as explained in step 3.

|

Federal returns - Using PINs. If you and your client are using PINs, you don't need to mail Form 8453 to the IRS. However, you may need to mail state electronic filing paperwork to the appropriate state service center. Continue with step 3.

Tip: The Mailing Form 8453 section of the Electronic Filing Information Worksheet shows the Form 8453 mailing address.

To print Form 9325:

1. Open the client's federal return.

2. Click the General Information button, then click the Form 9325 Input tab to open Form 9325.

3. Go to the File menu and click the Print button.

4. Click Close to close the ProSeries Basic Printing Message Log.

Federal taxes. If your client owes federal taxes, he or she must mail Form 1040-V and the payment to the IRS no later than April 17, 2006.

State taxes. If your client owes state taxes, complete the state tax payment voucher at the same time.

For more information about electronic filing, use the Search Help feature on the Help toolbar or in the Help Center.

|

Tip:

|

IRS refund cycle. For information about the IRS refund cycle, go to the IRS Web site at http://www.irs.gov.

|