Miscellaneous options

This section shows you how to enter miscellaneous information that the ProSeries program will apply to:

|

▪

|

All federal S corporation (Form 1120S) returns

|

Previous-year Miscellaneous information. When you install this year’s version of ProSeries/Client Organizer, ProSeries/1040, ProSeries/1040NR, ProSeries/1120S, or ProSeries/1065, the program transfers the Miscellaneous information that you entered in last year’s ProSeries/1040 product, if applicable. If this occurs, edit the transferred information as necessary.

Network. Miscellaneous global options affect all workstations.

|

Client templates. Set global miscellaneous options for Client Organizer files, federal (Form 1040 and Form 1040NR) individual returns, federal (Form 1120S) S corporation returns, or federal (Form 1065) partnership returns before you enter information in the corresponding client templates.

|

|

Availability. The Miscellaneous selection isn’t available when you open the Options dialog box from HomeBase. To see the Miscellaneous selection, you must open the Options dialog box from a Client Organizer file, a Form 1040 return, a Form 1040NR return, a Form 1120S return, or a Form 1065 return.

|

The following table lists the miscellaneous global option areas for each affected product:

|

|

Printing. To print the miscellaneous global options you’ve selected, right mouse click on the form (but not in a data field), then select Print from the shortcut menu that appears.

|

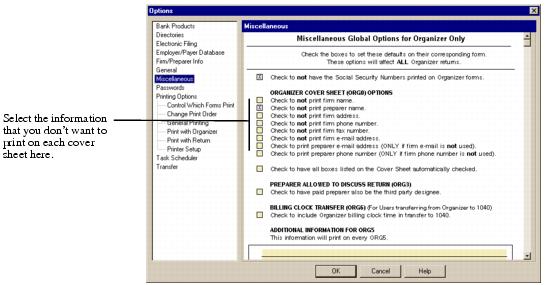

Miscellaneous global options for Client Organizer files

The miscellaneous global options that you select affect all Client Organizer files, including those that you previously transferred and opened.

To select miscellaneous global options for Client Organizer files:

|

2

|

Go to the Tools menu, select Options, then select Miscellaneous on the left side of the Options dialog box.

|

From here, you can select the following options:

|

Do not print or display Social Security Numbers on forms

|

Select this option if you want to hide all Social Security Numbers on Client Organizer forms. If you check this box, “On File” appears in Social Security Number fields on the screen. If you subsequently print forms, “On File” appears in the corresponding Social Security Number fields on the printed forms. However, ProSeries will transfer the Social Security Numbers to the clients’ ProSeries/1040 client files.

If you remove the check from this box, the Social Security Numbers reappear in the Social Security Number fields on the screen. If you subsequently print forms, the Social Security Numbers are printed in the corresponding Social Security Number fields on the printed forms.

|

|

Organizer Cover Sheet Options

|

Select any firm or preparer information that you don’t want to print on the Tax Organizer cover sheet. Choose to print the preparer’s e-mail address or phone number instead of the firm’s e-mail address or phone number.

If you want ProSeries to check all the boxes in the “Please provide the following information” section of every client’s Tax Organizer Cover Sheet (ORG 6), check the last box in this section.

|

|

Preparer Allowed to Discuss Return

|

Select this option if you want the program to check the Yes box for “Has preparer been designated by taxpayer to discuss this tax return with the IRS?” in the Filing Information section of the Federal Information Worksheet in each client’s federal return.

|

|

If you want to include the time that you spent working on a Client Organizer file when you transfer the data from that Client Organizer client file to a new ProSeries/1040 client file, check this box.

To use this option, you must activate the billing clock. Go to the Tools menu, select Billing, select Billing Clock, then select the Track time spent in each return option in the Billing Clock dialog box.

Tip. After you transfer data from the Client Organizer file to the individual return client file, the time that you spent on the Client Organizer file appears in the Org Hrs column in the Hourly Rate Billing section of the Client Billing Worksheet in the individual return client file.

|

|

|

Additional Information for ORG5

|

If you want to add additional information to every client’s Additional Information Worksheet (ORG5), click the first line of this section, then type the information.

Tip. Use this option to ask additional questions specific to your practice or your state. You can leave some lines blank.

|

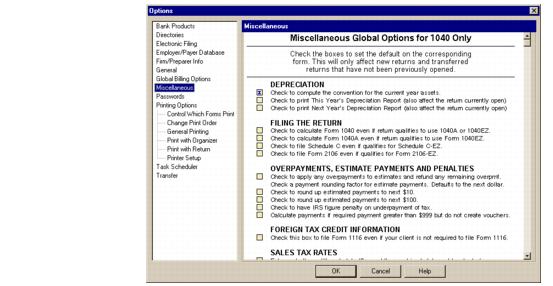

Miscellaneous global options for federal individual returns

The miscellaneous global options that you select affect all new returns and any transferred returns that you have not yet opened. To change the selections for a client, use the applicable dialog boxes and the appropriate fields on the client’s forms, schedules, and worksheets.

To select miscellaneous global options for federal individual returns:

|

2

|

Go to the Tools menu, select Options, then select Miscellaneous on the left side of the Options dialog box.

|

From here, you can select the following options:

|

Exceptions. You can change the depreciation convention option for a specific return on that client’s Depreciation Options Worksheet.

|

|

|

Exceptions. You can change the Form 1040 or Form 1040A, or Form 1040EZ options for a specific return on that client’s Federal Information Worksheet.

|

|

|

Overpayments, Estimate Payments and Penalties

|

|

|

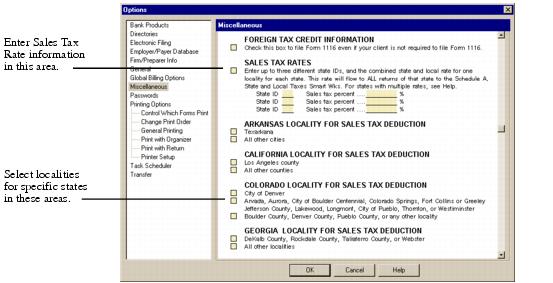

Foreign Tax Credit Information

|

Select this option if you want to include Form 1116 with a return when the form has information but the client isn’t required to file it.

|

|

Select this option then enter the state ID and a combined state and local sales tax percentage for up to three states if you want the sales tax percentages that you enter to flow to the State and Local Taxes Smart Worksheet for line 5 of Schedule A when you enter an applicable State ID in column (a), STATE ID, of the Smart Worksheet.

Note: If the combined state and local sales tax percentage is different for a specific county or city in a state, you can adjust the rate in the Smart Worksheet.

Note: For information about combined state and local sales tax percentages for Arkansas, California, Colorado, Georgia, New Jersey, and New York localities, see the next row of this table.

|

|

|

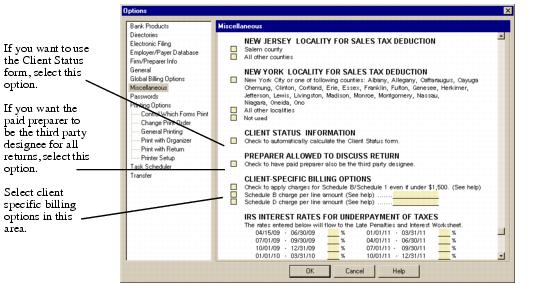

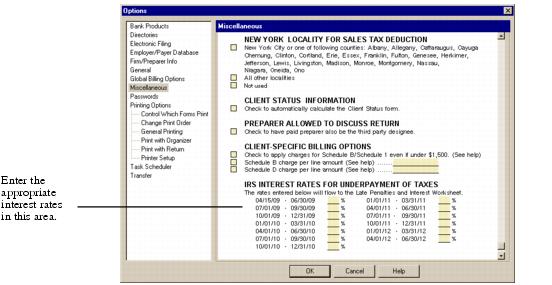

Arkansas, California, Colorado, Georgia, New Jersey, and New York Localities for Sales Tax Deduction

|

Select the applicable box in the Arkansas Locality, California Locality, Colorado Locality, Georgia Locality, New Jersey Locality, and/or New York Locality section(s) if you have clients in one or more of those states and you want the program to enter the applicable combined state and local sales tax percentage in the State and Local Taxes Smart Worksheet for line 5 of Schedule A when AR, CA, CO, GA, NJ, or NY is entered in column (a), STATE ID, of the Smart Worksheet.

Note: If the combined state and local sales tax percentage is different for a specific county or city in a state, you can adjust the rate in the Smart Worksheet.

|

|

Select this option if you want the program to calculate the Client Status form for each client automatically.

|

|

|

Preparer Allowed to Discuss Return

|

Select this option if you want the program to check the Yes box for “Has preparer been designated by taxpayer to discuss this tax return with the IRS?” in the Filing Information section of the Federal Information Worksheet in each client’s federal return.

|

|

Select this option if you want the program to apply per-form billing charges for Schedule B and Schedule 1, even if under $1,500.

|

|

|

IRS Interest Rates for Underpayment of Taxes

|

Enter the appropriate interest rates for each period of time. The program uses this information on the Late Payment and Filing Penalties and Interest Worksheet in each client’s federal return.

|

The following illustrations show options in the Miscellaneous Global Options for 1040 Only section of the Options dialog box.

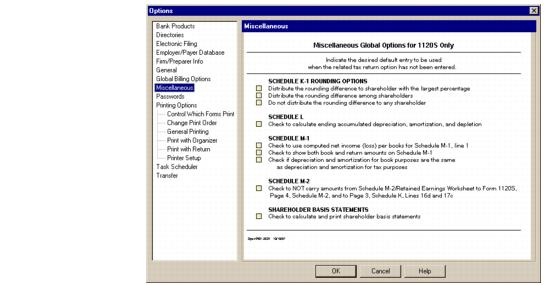

Miscellaneous global options for federal S corporation returns

The miscellaneous global options that you select affect all new Form 1120S returns and any previously‑transferred Form 1120S returns that you have not yet opened. To change the default selections for a client, use the appropriate fields on the client’s forms, schedules, and worksheets.

To select miscellaneous global options for federal S corporation returns:

|

2

|

Go to the Tools menu, select Options, then select Miscellaneous on the left side of the Options dialog box.

|

From here, you can select the following options:

|

Schedule K-1 Rounding Options

|

|

|

Select this option if you want the program to calculate ending accumulated depreciation, amortization, and depletion.

|

|

|

Select the Schedule M‑1 options that you want.

|

|

|

Select this option if you don’t want the program to flow amounts from the Schedule M‑2/Retained Earnings Worksheet to Form 1120S, page 4, Schedule M‑2, or to page 3, Schedule K, lines 20 and 22.

|

|

|

Select this option if you want the program to calculate and print Shareholder Basis Statements.

|

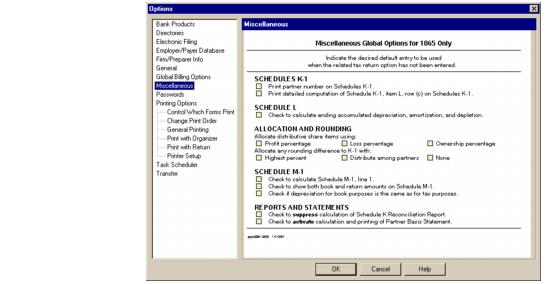

Miscellaneous global options for federal partnership returns

The miscellaneous global options that you select affect all new Form 1065 returns and any previously‑transferred Form 1065 returns that you have not yet opened. To change the selections for a client, use the appropriate fields on the client’s forms, schedules, and worksheets.

To select miscellaneous global options for federal partnership returns:

|

2

|

Go to the Tools menu, select Options, then select Miscellaneous on the left side of the Options dialog box.

|

From here, you can select the following options:

|

Select this option if you want the program to calculate ending accumulated depreciation, amortization, and depletion.

|

|

|

Select the Distributive Share Items option that you want, and select the Rounding Differences option that you want.

|

|

|

Select the Schedule M‑1 options that you want.

|

|

|

Select the first option if you want the program to not print the Schedule K Reconciliation Report.

Select the second option to activate the calculation and printing of the Partner Basis Statement.

|