Importing asset information from ProSeries client files

You can import information about assets that you’ve entered in ProSeries for this tax year in either of the following ways:

|

For on-screen instructions, go to the Help menu, select Tutorial Videos, then select Import Wizard.

|

Importing asset information from several ProSeries client files

To import asset information from several ProSeries client files at one time:

|

2

|

Go to the File menu and select Import.

|

|

3

|

Select ProSeries Tax.

|

|

4

|

In the Import from ProSeries dialog box, go to the Filter Type list and select the type of import filter that you want to use.

|

|

●

|

|

If a client file is protected by a password in ProSeries, it will not appear in the Select Client(s) section of the Import from ProSeries dialog box.

|

|

6

|

Click Import.

|

An Import from ProSeries dialog box keeps you informed about the progress of the import procedure.

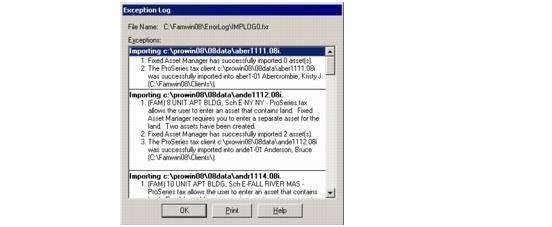

When Fixed Asset Manager finishes importing asset information, view the exception log to see if any errors occurred.

Importing asset information from one ProSeries client file

To import asset information from a ProSeries client file directly into an open Fixed Asset Manager client file:

|

2

|

Go to the File menu and select Import.

|

|

3

|

Select ProSeries Tax.

|

|

The Select Client(s) section of the Import From ProSeries dialog box shows only ProSeries client files that are the same type as the open Fixed Asset Manager client file.

|

|

5

|

Click Import.

|

When Fixed Asset Manager finishes importing asset information, you can view an exception report to see if any errors occurred.

Understanding import-related diagnostic messages

When you import asset information from ProSeries client files, Fixed Asset Manager may display any of the following diagnostic messages:

|

▪

|

Car and Truck Worksheets — If a ProSeries client file includes a Car and Truck Worksheet, the exception log indicates that assets on that worksheet were not imported into Fixed Asset Manager.

|

|

▪

|

Locked client file — The ProSeries client file from which you want to import asset information is currently open and not accessible.

|

|

▪

|

Client file already exists — The ProSeries client file is already associated with an existing Fixed Asset Manager client file. Continue importing asset information from the ProSeries client file or stop the import procedure.

|

|

▪

|

No property description — There are assets linked to multiple-copy forms and there aren’t descriptions that identify the specific copy of the multiple-copy forms.

|

|

▪

|

Invalid fiscal year dates (in client information) — Dates in the ProSeries client file are invalid or inconsistent with the Fixed Asset Manager client.

|

|

▪

|

Invalid small corporation information — Small corporation information in the ProSeries client file is invalid or inconsistent with the Fixed Asset Manager client.

|

|

▪

|

Invalid method(s) — Methods in the ProSeries client file are invalid. Assets may contain errors.

|

|

▪

|

Current personal tangible property for which the user has indicated is not eligible for the Section 179 deduction — Fixed Asset Manager does not store information to indicate that an asset is not eligible for Section 179. Current-year assets meeting this condition are not imported.

|

|

▪

|

General Asset Account assets — Fixed Asset Manager does not support General Asset Account assets.

|

|

▪

|

Office-in-home assets (1040) — Fixed Asset Manager does not support Office-in-home assets.

|

|

▪

|

Passive activity assets (1120) — Fixed Asset Manager does not support assets for which the Is passive activity check box is checked Yes on Form 1120.

|

|

▪

|

Assets linked to 6252 — Fixed Asset Manager does not support assets that are linked to Form 6252, Installment Sales.

|

|

▪

|

MACRS Table assets — Fixed Asset Manager computes MACRS depreciation using only the formula method (remaining depreciable basis over the remaining recovery period multiplied by the depreciation rate).

|

|

▪

|

Assets acquired in a like-kind exchange — Fixed Asset Manager does not support the modified MACRS recovery period prescribed for assets acquired in a like-kind exchange. (See IRS Notice 2000-04.)

|